Quick guide to the role of FIUs in asset recovery

By Thierry Ravalomanda, Senior Asset Recovery Specialist, Basel Institute on Governance

Also available in: Español, Français, Português

Practically every country has a Financial Intelligence Unit (FIU) and it plays a vital role in combating money laundering and other financial crimes. Yet there is often confusion – even among anti-corruption authorities – about how it works, what it can

and can’t do, and what value it brings. Here is a very quick overview.

A vital buffer role

One major role of an FIU is to help filter out potentially illegal financial transactions that should be further investigated by the police or other competent law enforcement authority.

In a nutshell: Banks and other businesses that conduct transactions on behalf of clients sometimes notice a suspicious transaction but don’t have hard evidence of illegality. Instead of going directly to law enforcement, they first contact the country’s

FIU to analyse the transaction and decide whether or not further action is needed.

This buffer role is important not only for catching criminals but for recovering assets arising from their crimes.

What can FIUs do?

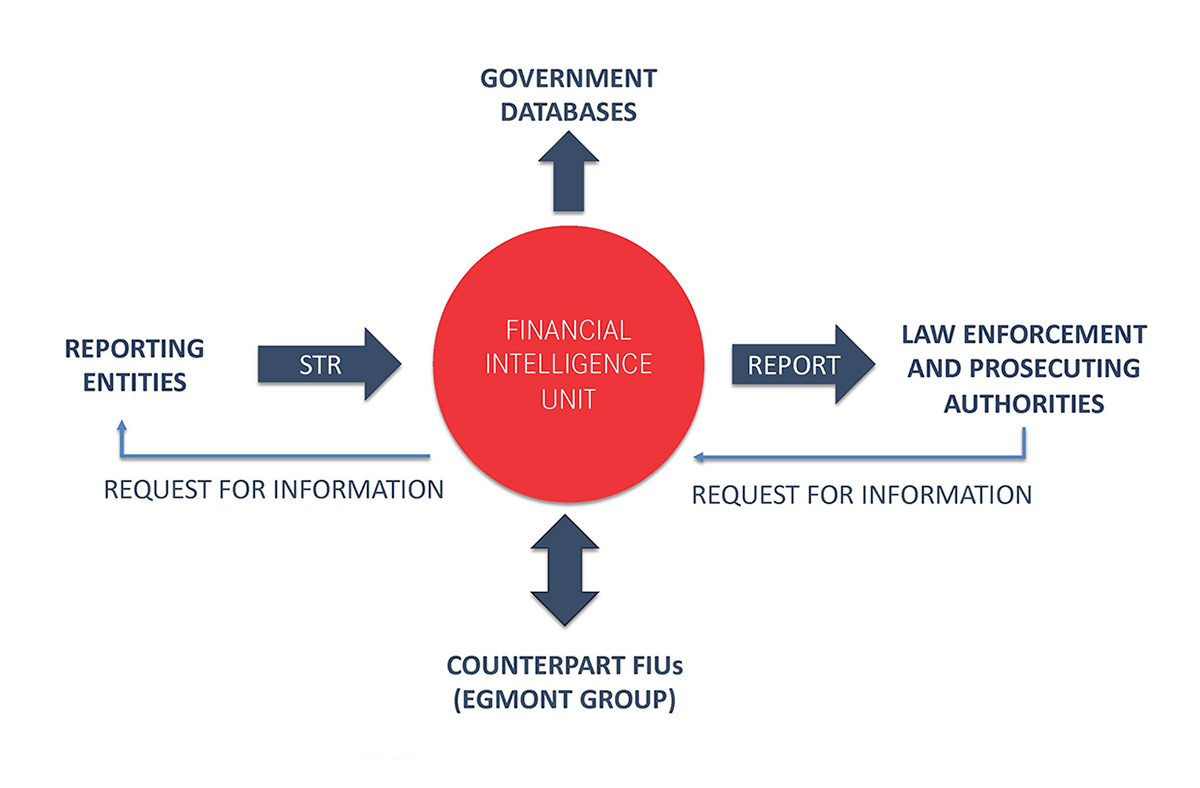

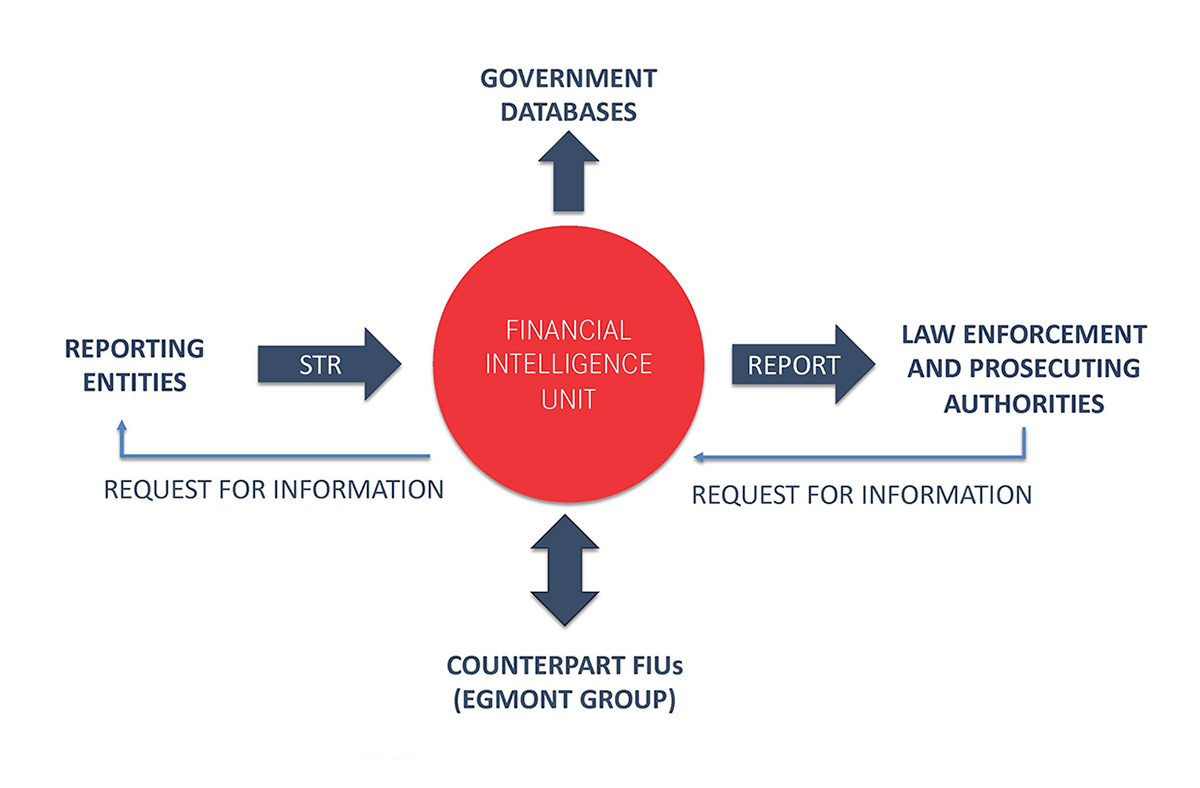

A Financial Intelligence Unit (FIU) is a central national agency. Its role is to receive, analyse and disseminate Suspicious Transaction Reports (STRs) or other financial information submitted by reporting entities.

Most FIUs are independent administrative bodies. Some are established within the judicial branch of government and have additional powers, for example to conduct searches or seize assets. Others countries have so-called law enforcement FIUs with stronger

investigative powers. You can see a full description of the different types of FIUs here.

What is a reporting entity?

Reporting entities are businesses that are legally obliged to put in place a preventive framework for anti-money laundering/countering financing of terrorism (AML/CFT). There are two types:

- Financial institutions (e.g. banks, insurance companies, currency exchange services);

- Designated non financial businesses and professions (e.g. lawyers, accountants, casinos).

The preventive framework takes a risk-based approach and involves a set of measures with acronyms like CDD (customer due diligence), EDD (enhanced due diligence) and KYC (know your customer). The aim is to make sure that customers are who they say they

are and are not carrying out illicit financial transactions.

And what is an STR?

While monitoring client activities and accounts as part of this framework, the reporting entity might spot transactions that don’t match the client’s profile, such as large deposits or withdrawals, or complex transactions with no clear economic justification.

If they suspect the funds involved might come from the commission of a crime, they must file a Suspicious Transaction Report (STR, sometimes called Suspicious Activity Report) with the FIU.

What an FIU does with an STR

The FIU analyses the STR with the aim of confirming or dispelling the suspicion. They can go back to the reporting entities to get additional information, like bank statements and client histories, and can access government databases such as criminal

records or property registries.

What an administrative FIU does is pre-investigation, not investigation. It produces intelligence, not evidence. Law enforcement FIUs have the additional power to investigate, for example interview suspects or seize assets,

and produce evidence that can be used in court.

The role of the Egmont Group

A vital one. The Egmont Group of Financial Intelligence Units is an informal network of almost all FIUs worldwide and acts as an important platform for information exchange.

Many suspicious transactions have an international element, for example large amounts of money being transferred to or from a foreign country. An FIU can contact its counterpart in the other country and ask confidentially for information about the transaction

and the individuals or companies involved. It is quick, effective and immensely valuable – but it is informal, and this intelligence can’t be used as evidence.

If the FIU concludes that the transaction should be reported to the competent law enforcement authority, that authority has to obtain the same and additional information through the formal process of mutual legal assistance in order for it to be admissible

in court.

How FIUs contribute to asset recovery

We sometimes think of “asset recovery” as simply the confiscation and return of illegally obtained assets to the country from which they were stolen. In fact, the return of the money is just the most headline-grabbing part of a long process that goes

right back to the pre-investigative stage to which the FIU may have contributed.

During this pre-investigate stage, the FIU conducts a thorough analysis and may be able to identify possible commission of a financial crime such as money laundering, as well as the predicate offence – the crime at the origin of the illegal funds.

It can also identify assets used to commit the crime and any assets that are the proceeds of the crime.

The FIU uses all its powers, all the information available to it, plus international connections through the Egmont Group, to create operational intelligence. It then makes this intelligence available to the competent authority investigating the case.

Institutional training programmes and free eLearning courses