Общее

Section outline

-

-

Quick guide to offshore structures and beneficial ownership

Phyllis Atkinson, Head of Training ICAR, Basel Institute on Governance

Also available in: Español, Português

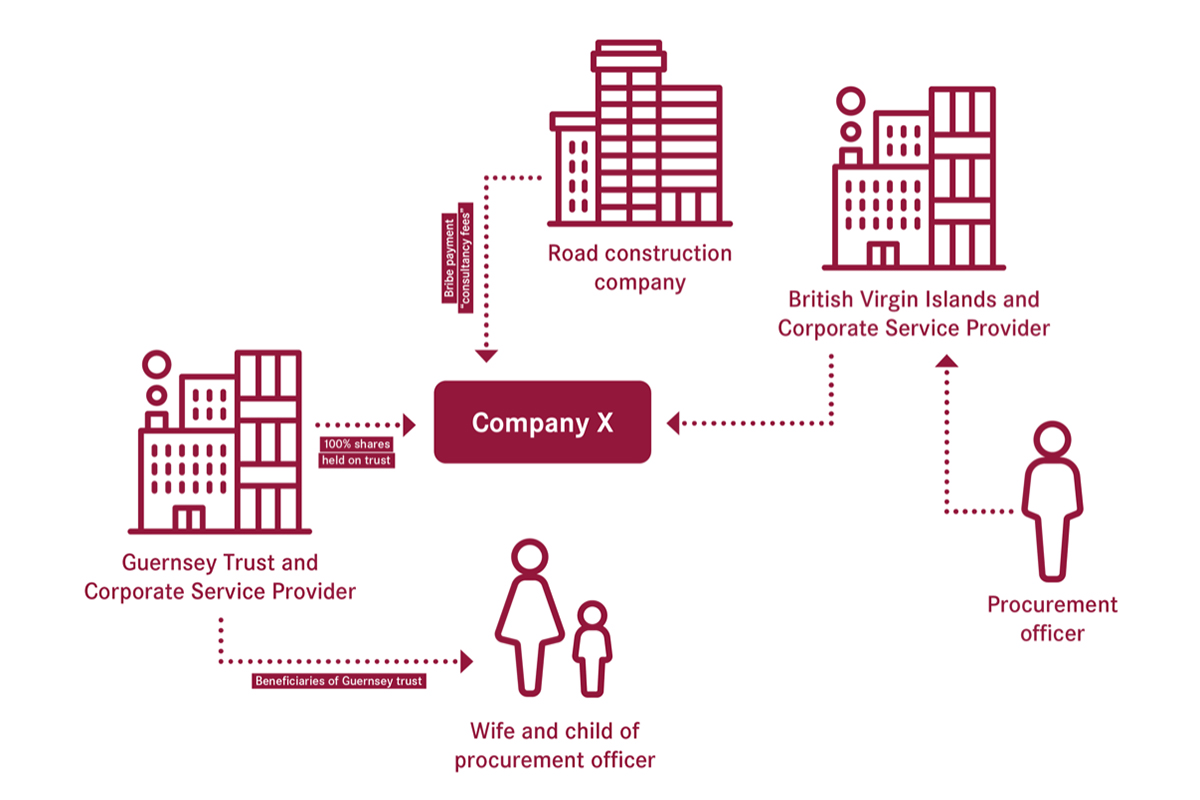

Money laundering schemes frequently involve complex webs of transactions and structures that offer disguise, concealment and anonymity, and transcend international borders. The use of corporate vehicles or “structures” is a common way to launder dirty money and make it appear to come from a legitimate source.

Yet while major corruption and money laundering cases often have an international dimension and involve such complex schemes, investigators and prosecutors generally have little knowledge of corporate vehicles outside their own country, and often lack the resources to obtain evidence from other jurisdictions. These difficulties are compounded by differences in legal systems and terminology, and by the random use of terms like “tax haven” and “secrecy jurisdiction”.

This quick guide looks at how criminals obtain a veneer of respectability and exploit secrecy by manipulating and misusing corporate vehicles in offshore jurisdictions. It focuses on the meaning of "corporate vehicle" and "offshore" and other related concepts such as beneficial ownership. It also gives an example of how a trust, which is one common type of corporate vehicle in the vast "offshore ecosystem", can be used for illicit purposes.

What is a corporate vehicle?

Corporate primarily means relating to a company, as defined here. From the juristic point of view, a company is a separate, legally recognised corporate entity, created by means of a fictional veil between the company and its members. This “corporate veil” shields the people behind the company from personal liability. The corporate veil is pierced when:

- Firstly, it is established that the individuals behind the corporate entity control its finances and business practices to the extent that it no longer has a separate will or existence.

- Secondly, the control has resulted in a criminal, dishonest or unjust act which caused injury or unjust loss.

Corporate vehicles, including corporations, trusts, foundations, partnerships with limited liability and similar structures, have become an integral and indispensable component of the modern global financial landscape. However, as the Financial Action Task Force (FATF) has emphasised for years, they may be exploited for unlawful purposes including money laundering, in addition to bribery/corruption and the misappropriation of public funds.

Criminals can be extremely creative in their use of techniques and mechanisms to obscure their ownership and control of illicitly obtained assets. The challenge for practitioners is to "see through" the corporate veil provided by the structure to identify the controlling party and ultimate beneficial owner.

Offshore financial centres – what and where are they?

Although the term offshore is not defined by the FATF, in the context of corporate vehicles, offshore refers to something located or based in a foreign country. It is commonly used to describe foreign banks, trusts, corporations, investments and deposits.

Although a company may legitimately move offshore for the purpose of (legal) tax avoidance or to enjoy relaxed regulations, offshore structures can also be used for illicit purposes such as money laundering and tax evasion. This is particularly the case for structures such as companies, partnerships or trusts formed in offshore financial centres (OFCs).

OFCs are jurisdictions whose corporate vehicles are primarily used by non-residents. They include well-known centres like Switzerland, Bermuda and the Cayman Islands, and less well-known centres like Mauritius, Dublin and Belize. The level of regulatory standards and transparency differs widely among OFCs.

The significance of offshore jurisdictions in the context of criminal investigations is the manner in which some provide excessive secrecy for their corporate vehicles, thereby creating a favourable environment for their use for illicit purposes.

How are corporate vehicles used for criminal purposes?

Corporate vehicles often play a central role in concealing the proceeds of corruption, money laundering and the beneficial ownership of illicit assets.

Corrupt public officials and money launderers do not want to keep their dirty money in their own names. Therefore, what they typically do is create a company – or a series of companies – and have the company own their assets. The company can open a bank account, buy a yacht or a mansion, and wire money around the world. Particularly in offshore jurisdictions that offer excessive secrecy for their corporate vehicles, it is immensely difficult and sometimes totally impossible to trace the money back to the person who really owns it. This makes these vehicles an attractive mechanism for hiding, moving and using illicitly obtained money or other assets.

There is a large range of corporate vehicles in different jurisdictions. Sometimes they have the same or similar names but different characteristics or else similar characteristics but different names. This brief description of three commonly used structures – shell companies, shelf companies and trusts (in the English common law tradition) – is designed only to give a flavour of how offshore structures can be abused.

Shell company

A shell company can be defined as a non-operational company, i.e. a legal entity that has no independent operations, significant assets, ongoing business activities or employees. Typically, a shell company is provided by a professional intermediary to a corrupt party who then uses it to obscure the money trail by transferring the illicit funds into and out of the company’s bank accounts.

A shell company has no physical presence in its jurisdiction. Its main or sole purpose is to insulate the real beneficiary (ultimate beneficial owner) from taxes, disclosure or both. Shell companies are also referred to as front companies or mailbox/letterbox companies. One specific type of shell company structure is the international business corporation (IBC) which is typically used for shell companies set up by non-residents in OFCs. IBCs make ideal shell companies because they are not permitted to conduct business in the incorporating jurisdiction and are generally exempt from local income taxes.

Shell companies constitute a substantial proportion of the corporate vehicles established in some OFCs. Given their function, shell companies face an increased risk of being misused.

Shelf company

A shelf (or off the shelf) company is a category of, and similar to, shell companies, in that it offers no real "brick and mortar" company. A shelf company is a corporation that has had no activity. It has been created, left dormant and put on the "shelf". This corporation is then later usually sold to someone who would prefer to have an existing corporation than a new one. The significant difference between shell and shelf companies lies in the age of the respective companies since incorporation, with the value of a shelf company being based upon its history and banking relationships in addition to its age.

In some jurisdictions, incorporation procedures can be time-consuming. It is often easier, quicker and less expensive to transfer ownership of a shelf company than to incorporate a new one. Lenders sometimes require a business to have been in existence from six months to two years or more before lending it money, and many agencies will only sign contracts with a company that has been in business for at least two years.

Trust

The concept of a trust is probably less familiar with most than that of the company but it has been around for longer. The trust is a legal relationship which originated historically in England and developed mainly in states with a common law or Anglo-Saxon legal tradition, e.g. Great Britain, USA, Australia, Canada, South Africa and New Zealand. Structures similar to trusts can be found in other countries, e.g. Japan, Panama, Liechtenstein, Mexico, Colombia, Israel and Argentina.

A trust in this sense is a legal arrangement or relationship whereby a person ("trustee") owns assets not for their own use and benefit but for the benefit of others ("beneficiaries"). Unlike a company, it is a corporate vehicle which does not have a separate legal personality and distinguishes legal ownership from beneficial ownership of assets vested in a trust.

The key points to understand are:

- The essential components or parties to a trust are the settlor, trustee, beneficiaries and trust property.

- The settlor transfers ownership of certain assets to trustees by means of a trust deed or declaration of trust (although it does not have to be reduced to writing).

- These assets are to be managed and used for the benefit of named or unnamed beneficiaries. This constitutes a binding obligation.

- In the process of transferring, or "settling", certain property, the legal ownership or control of the assets (known as the trust property) is separated from the beneficial interest in such assets.

In this context, a beneficiary is a person who is designated to receive something as a result of a trust arrangement. A trust may be set up with no identified existing beneficiaries, but the beneficiaries to a trust must be ultimately ascertainable. In this case, the trust provides the trustee with certain powers to administer the assets, which operate until such point when, under the terms of the trust, an individual or group of individuals become entitled as beneficiaries to income or capital on the expiry of a defined period. Some types of trust allow the beneficiary to be named or changed at any time, meaning their identify can be kept secret until ownership of the assets is transferred to them.

The separation of the legal ownership of the trust assets, which lies with the trustee, from the right to benefit from those assets, which lies with the beneficiaries, is the crucial factor to understanding trusts. Simultaneously, it is essential to understand that a "beneficiary" is not the equivalent of a "beneficial owner" (see below).

Unravelling beneficial ownership of trusts

During a criminal investigation involving corporate vehicles, particularly those formed in offshore jurisdictions, the crux of the issue for any practitioner is identifying the "beneficial owner" of the corporate vehicle. This refers to the person (or group of people) who have an interest in or control over ill-gotten gains and are trying to conceal the fact through the misuse of corporate vehicles.

According to the FATF definition, beneficial owner refers to the natural person(s) who ultimately owns or controls an asset, and directly or indirectly enjoys its benefits. The beneficial owner also owns or controls the customer and/or the natural person who may appear to own or control the asset and on whose behalf a transaction is being conducted in order to hide the true ownership. The term also includes those persons who exercise ultimate effective control over a legal person or arrangement.

The defining characteristic of the beneficial owner of a trust asset (as opposed to a beneficiary) is that he (or she) holds a degree of control over the asset that allows him to benefit from it. Whether he is the legal owner, i.e. holds a legal title to it, or a trust beneficiary is irrelevant. Importantly, a beneficial owner must always be a natural person, as a legal person cannot exert "ultimate" control over an asset. This is due to the fact that legal persons are always controlled, directly or indirectly, by natural persons.

In the context of legitimate trusts, none of the following qualify as the beneficial owner as previously defined:

- The trustee exerts control over an asset but is not an ultimate controller as he is legally bound to act in the interests of the beneficiary.

- The settlor of the trust initiates the trust and relinquishes legal ownership of trust assets to the trustee for the benefit of the beneficiary; however, he may also continue to exert some level of control or influence over the trust.

- The beneficiary stands to benefit but generally cannot exercise any control over the trust.

However, for criminal investigative purposes, beneficial ownership for trusts can arguably encompass a combination of actors: the settlor, the trustees, the beneficiaries or any other individual who, in practice, exercises ultimate effective control over the trust and enjoys its ill-gotten benefits.

Find out more

- These topics are covered in much (much!) greater detail and depth in training courses of the International Centre for Asset Recovery (ICAR), in particular on Offshore Structures and Mutual Legal Assistance.

- As Head of Training ICAR, the author Phyllis Atkinson has developed and delivered highly specialised training on these and related topics to investigators, prosecutors, financial analysts and judges all over the world. You can find out about ICAR’s unique approach to training in her quick guide to effective training on financial investigations.

- The OECD’s 2001 publication Behind the Corporate Veil: using corporate entities for illicit purposes looks at the types of corporate entities that are most frequently misused and “urges governments to combat such misuse by acting to ensure the availability of information about ownership and control”.

- Key FATF publications on this topic include: FATF guidance on transparency and beneficial ownership (October 2014) and Best practices on beneficial ownership for legal persons (October 2019).

- Download this quick guide as a PDF.

Scenario: A money laundering scheme using offshore jurisdictions and structures:

-